On September 19th and 20th, the Federal Reserve is set to convene another FOMC (The Federal Open Market Committee) meeting. While market attention is largely centered on unemployment and inflation figures, I've consistently underscored in various articles the potential hazards posed by ongoing interest rate hikes to the U.S. banking sector, as well as the enormous strain on the U.S. fiscal deficit. The repercussions of the Silicon Valley Bank incident six months ago did not destabilize the entire U.S. banking system. However, can other banks or financial institutions remain complacent?

Who will be the next potential ticking time bomb?

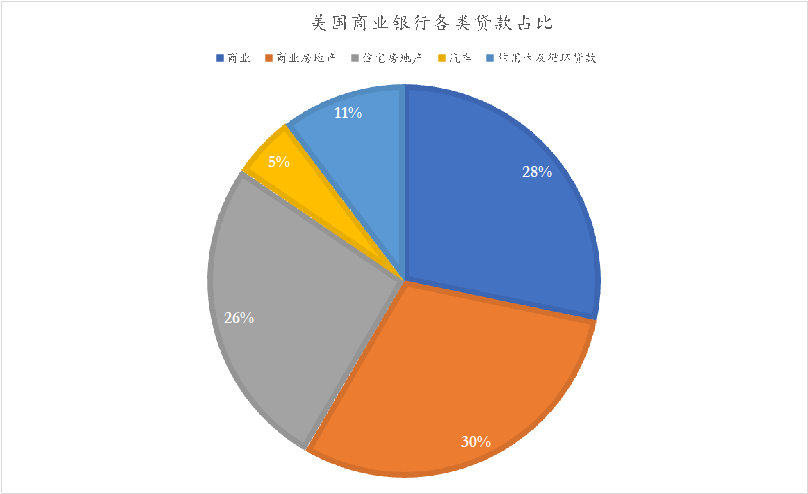

The sector most intrinsically linked to the financial system must be real estate. Within American commercial bank loans, commercial real estate represents 30%, while residential real estate accounts for 26%. It's no exaggeration to state that real estate holds significant sway within the banking landscape. Beyond banks, numerous other financial institutions play pivotal roles in the real estate market, such as Freddie Mac and Fannie Mae, which became widely recognized during the subprime crisis. As the Federal Reserve consistently raises interest rates, our focus shouldn't just be on the short-term liquidity challenges posed by regional banks investing in US Treasuries. Another evolving concern is the escalating pressures on the broader financial system emanating from the US real estate sector, especially after the Federal Reserve's rapid rate hikes over the past year.