On March 12th, the United States released its Consumer Price Index (CPI) for February, showing a year-over-year increase of 3.2% and a month-over-month rise of 0.4%. This growth exceeds both January's figures and the anticipated 3.1%, marking the largest increase since September of the previous year. Undoubtedly, this data provides the Federal Reserve with a strong justification to maintain interest rates at the upcoming 3/19-3/20 FOMC meeting. Despite this, the US stock market reacted oppositely, with the S&P 500 reaching an all-time high and closing by up 1.12%.

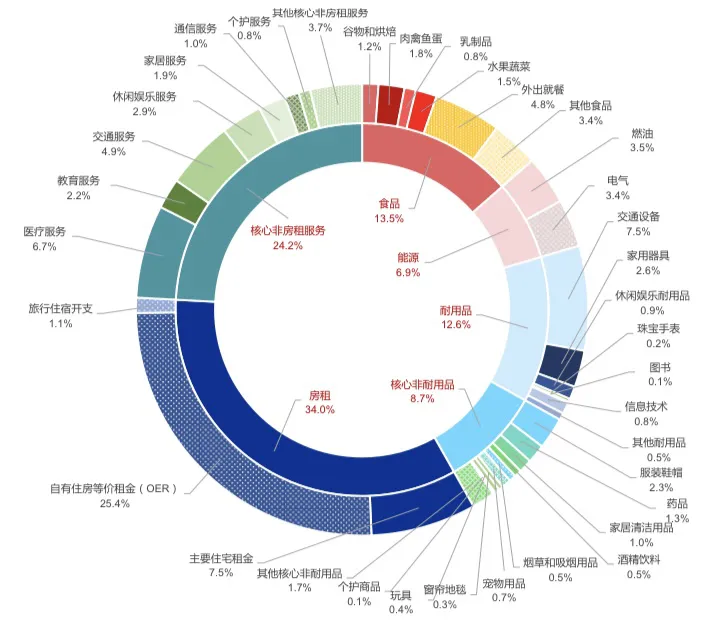

Since October 2021, I have frequently analyzed US inflation and suggested, since March last year, that more attention should be paid to the resilient core inflation, particularly the changes in Owners' Equivalent Rent (OER). In fact, before the February CPI release, the Fed had already indirectly controlled CPI growth by adjusting OER in January. Therefore, we can further analyze the main reasons behind this unexpected CPI rise and the underlying logic of these adjustments, which may provide us with alternative insights and interpretations.